Citibank Epay India

Citibank India Type Subsidiary of Citigroup Industry Banking Financial services Founded 1902; 119 years ago Headquarters Mumbai, Maharashtra, India Key people Pramit Jhaveri (Vice-Chairman) [1] Ashu Khullar (Chief Executive Officer) [2] Products Credit Cards Debit Cards Loans Investments Assurance/Insurance NRI Banking Private Banking Owner Citigroup Website www. citibank Citibank India is a foreign bank in India with a full service onshore platform. Its Indian headquarters is at Bandra Kurla Complex, Mumbai, Maharashtra. It is a subsidiary of Citigroup, [3] a multinational financial services corporation headquartered in New York City, United States. Citibank India's services are investment banking, advisory and transaction services, capital markets, risk management, retail banking, and Cards. Although headquartered in Mumbai, the bank has most of its workforce based out of Chennai followed by Mumbai and Gurugram. History [ edit] Established in 1902 in Calcutta ( Kolkata), Citi India has a long history.

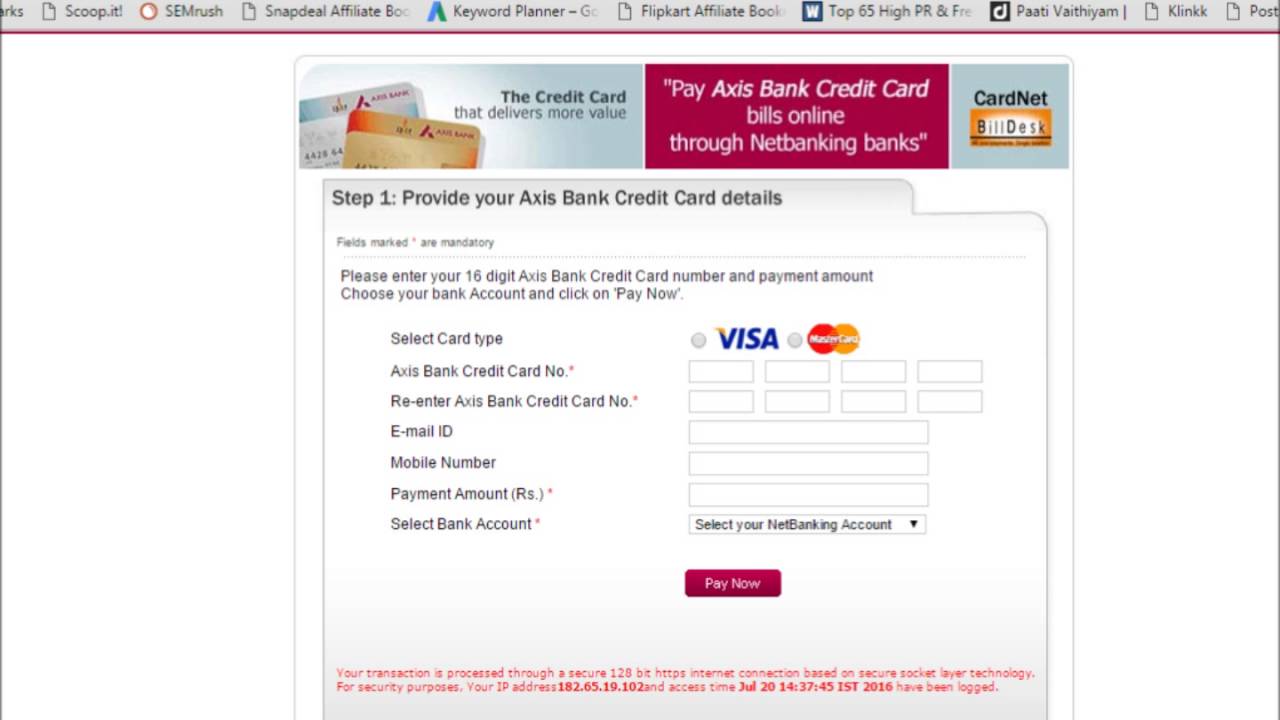

Citibank online epay

3 billion - 17 percent of such deals by all banks - according to the report by R. Janakiraman, deputy governor of the central bank. Mr. Bhatia said Citibank was being wrongly portrayed as the villain and dismissed accusations by prominent broker Harshad Mehta that it had masterminded the scandal. When Mr. Mehta talked to the parliamentary committee earlier this month he had produced no evidence against Citibank, Mr. Bhatia said. "It's a figment of his imagination, " he said. Mr. Bhatia declined to make available a copy of Citibank's responses to the Janakiraman report but outlined the contents in an interview with Reuters. "Effectively, what we've told them is that whatever issues have been brought up, they did not have full knowledge of them before submitting the report, " Mr. Bhatia said. "We did not have the opportunity to respond before the report was published, " he said. Citibank had "not done any irregular securities transactions, " Mr. Bhatia added. Responding to central bank allegations that Citibank's bankers receipts - promissory notes issued to pledge delivery of government securities - were improperly formatted and were signed by only one instead of the required two signatories, Mr. Bhatia said this was common market practice that had since been rectified.

- Los 8 mejores alimentos no perecederos

- Citi India - Credit Cards, Personal & Home Loans, Investment, Wealth Management & Banking

- El líder que no tenía cargo resumen

- Semaforo plc

- Online Card Payment | Citi India

- Derrel' s mini storage willow and alluvial

- Ainda ontem cifra

- Payments and Transfers - Online Cheques | MEPS | Inbound Funds Transfer - Citibank Singapore

- Encuentra aquí información de Atenas y Esparta para tu escuela ¡Entra ya! | Rincón del Vago

- Citibank epay india.com

- El principe idiota pdf video

- Citibank epay online payment

How does this affect my outgoing transfers? Any existing outgoing transfers from Citibank will not be affected by the change in BIC and Bank Code. However, from 15 April 2019 onwards, you will need to ensure you select the correct BIC (refer to Table 1 above) when you initiate new SGD fund transfers from your Citibank Singapore Limited account to other Citibank Singapore Limited and Citibank N. A., Singapore branch account. No action is required for your existing payment set up. In the event you experience difficulties in transferring funds to your Citibank Singapore Limited account, please delete your existing setup and re-establish a new transfer instruction. 3. How does this affect my incoming transfers? With effect from April 15 2019, the SWIFT Bank Identifier Code (BIC) will be changed to CITISGSL. This is applicable for all new SGD fund transfers (for SGD only) setup done via inter-bank payment platforms such as Fast and Secure Transfer ("FAST"), Inter-bank GIRO ("GIRO"), MAS Electronic Payment System ("MEPS") and Telegraphic Transfers ("TT") to Citibank Singapore Limited.

Citibank epay india corporate

In order for incoming SGD funds/payments (for SGD only) to your Citibank Singapore Limited account(s) to be successfully processed, please provide the SWIFT Bank Identifier Code (BIC) as CITISGSL to the relevant parties. Payments made to an account(s) with incorrect BIC will not be processed and you may incur additional charges. For incoming transfers in other currencies, there is no change in current BIC Code (CITISGSGGCB) and Bank Code (7214). 4. Are there are any changes for my existing 'account payee' of another Citibank Singapore Limited account, already set up in my account? No, there is no change to your existing account payee set up. 5. What should I do if I want to add a new payee of another Citibank Singapore Limited account? If you are adding a payee via Citibank Online or Citi Mobile App, select Citibank Account (local) or 'Electronic Transfer (GIRO/MEPS/FAST). If you have selected to make a SGD payment via Electronic Transfer, please ensure you enter the correct SWIFT Bank Identifier Code (BIC).

6. What do I have to do when I transfer funds to another party's Citibank N. A., Singapore Branch account from 15 April 2019 onwards? There will be no change to the legal entity name and corresponding bank identifier codes for fund transfers to Citibank N. A., Singapore Branch accounts. As such, you do not need to make any changes in any pre-established payees which you may have set up for regular funds transfers to Citibank N. A., Singapore Branch accounts. However, please note that there will now be two bank names, Citibank NA Singapore and Citibank Singapore Limited, on the various inter-bank payment platforms (FAST, GIRO, MEPS, TT) To ensure that your transaction is processed successfully, kindly ensure that you select the correct Citi legal entity name and corresponding bank identifier codes when you initiate and/or receive payment instructions per stipulated in Table 1 as shown above.